what is a secondary property tax levy

Property tax is a levy based on the assessed value of property. What is the difference between a tax rate and a tax levy.

A lien is a legal claim against property to secure payment of the tax debt while a.

. Levy Limits Homeowners Rebate Tax Deferral Exemptions. 301 West Jefferson Street Phoenix Arizona 85003 Main Line. Ad Owe back tax 10K-200K.

The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General. It can garnish wages take money in your bank or other financial account seize and sell your vehicle. It is different from a lien while a lien makes a claim to your assets.

Search the tax Codes and Rates for your area. FY 202122 Tax Rate. Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on.

The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the. See if you Qualify for IRS Fresh Start Request Online. 113 rows The Pima County Property Tax Help Line can answer questions about how your property tax was calculated.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. Secondary Tax Rates are used to fund such things as bond issues budget overrides and special district funding. See if you Qualify for IRS Fresh Start Request Online.

Prior to 2019 CCC also levied a secondary property tax which was not renewed by voters. Property tax has two components. Property tax is the tax liability imposed on homeowners for owning real estate.

The assessment ratio for residential properties is 10. The City of Mesa does not collect a primary property tax. A tax levy is a collection procedure used by the IRS and other tax authorities such as the state treasury or bank to settle a tax debt that you owe to them.

What is an assessed value. View the history of Land Parcel splits. Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district tax property description total tax due for 2019 parcel.

1 PDF Editor E-sign Platform Data Collection Form Builder Solution in a Single App. A levy is a legal seizure of your property to satisfy a tax debtLevies are different from liens. View all options for payment of property taxes.

Ad Owe back tax 10K-200K. Ad Vast Library of Fillable Legal Documents. What Is a Property Tax Levy.

The LPV is multiplied by an assessment ratio to reach the propertys assessed valuations AVs. Primary and secondary property taxes. Best Tool to Create Edit Share PDFs.

The rates for the municipal portion. For additional questions on tax rates and CCCs budget please contact CCC at 928 527-1222. A municipal portion and an education portion.

Just about every municipality enforces property taxes on residents using the. FY 202021 Tax Levy chg. A tax rate is the percentage used to determine how much a property taxpayer will pay per one hundred dollars of net assessed.

Secondary Property Tax Levy debt repayment. A tax rate is figured by dividing the total secondary property tax levy by the total assessed value in town to determine each property owners share of the levy. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets.

Why India S States Are Antsy About Money Mint

New York Property Tax Everything You Need To Know

Part 1 General Principle Docx 2 Part 1 General Principles Mutiple Choice Choose The Correct Studocu

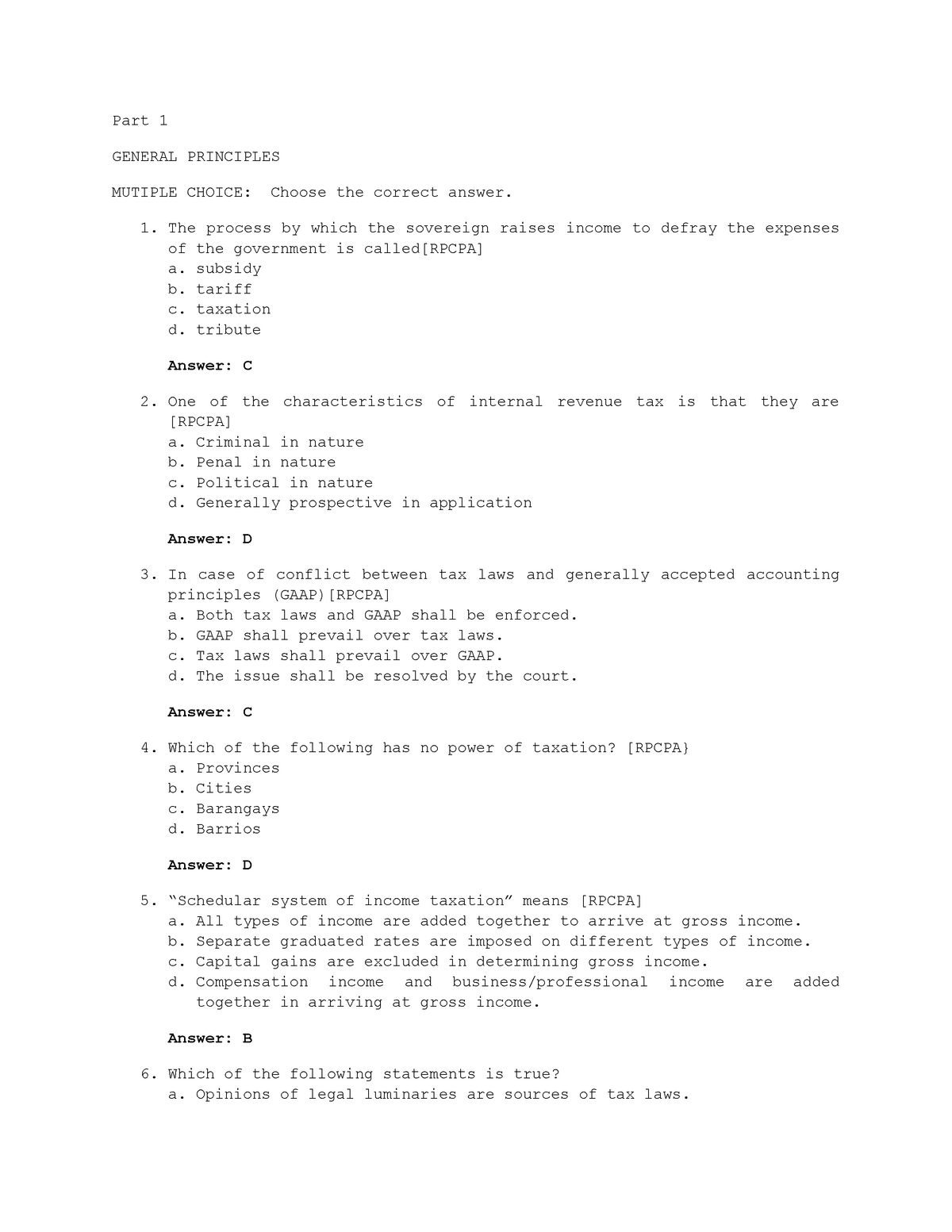

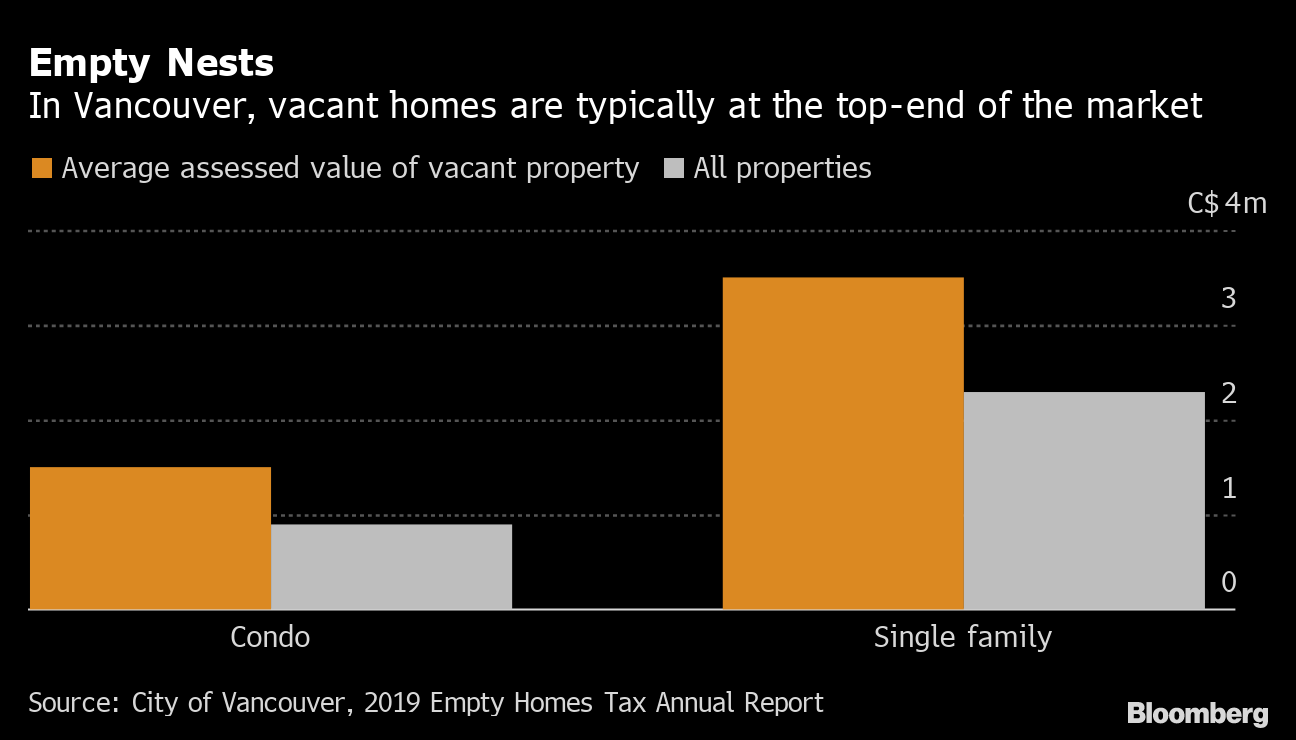

Taxing The Rich Do Housing Prices Fall When Empty Second Homes Are Taxed Bloomberg

Greater Sudbury Property Tax 2021 Calculator Rates Wowa Ca

Hst On Real Estate Levy Zavet Law

City Of Cranbrook Council Adopts Budget Monday Night Endorsing 2 75 Property Tax Increase

Johor Plans New Property Tax Levy On Foreigner Buyer Malaysia Real Estate Property

A Guide To The Imu Tax Studio Legale Capecchi

Taxing The Rich Do Housing Prices Fall When Empty Second Homes Are Taxed Bloomberg

Taxing The Rich Do Housing Prices Fall When Empty Second Homes Are Taxed Bloomberg

Taxing The Rich Do Housing Prices Fall When Empty Second Homes Are Taxed Bloomberg

Susan Wright Susanspbx Twitter